Donate Stocks and Securities

Maximize the benefits to you and Seva Canada’s programs by directly donating securities. Your gift of appreciated securities will transform lives for those in need and can create tax savings for you.

Gifts of securities to a registered charity is one of the most tax effective ways to give. You can benefit from a donation tax credit and the elimination of the capital gains tax that you would pay if you sold the same shares and donated the proceeds. Your estate can also see these same benefits if you choose to leave a gift of securities in your Will.

Listed securities include stocks, bonds, mutual funds and futures traded on approved stock exchanges in Canada, and major international exchanges. Most securities are held electronically and can be easily transferred to Seva Canada. Upon request, this can be arranged by your Financial Advisor.

By donating appreciated securities, you will receive a tax receipt for the full market value of the securities and you will have the satisfaction of knowing you are helping to restore sight and prevent blindness.

Follow these links for Find more information on making a gift of securities to Seva Canada or download a securities transfer form.

Questions? Contact Erika Kinast

A $50 donation will change a life!

News

From Vision to Reality: How a Revolutionary Eye Care Partnership is Changing Lives

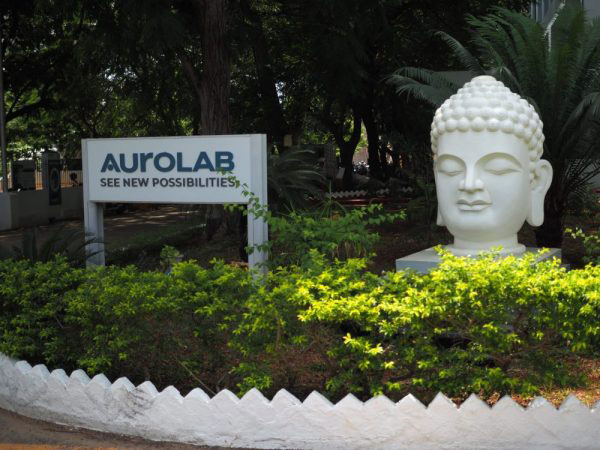

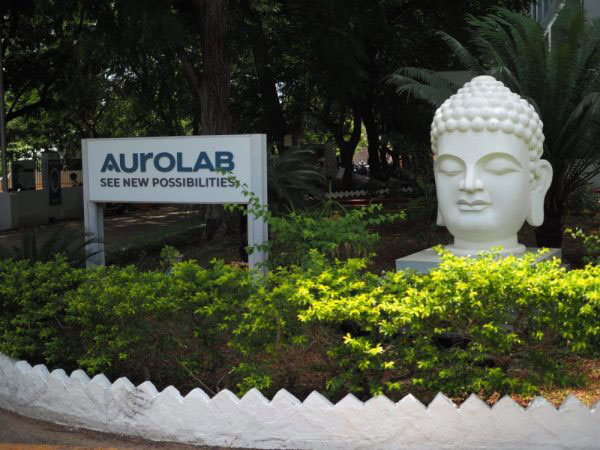

Walking through Aurolab’s manufacturing facility in Madurai, India, I was struck by the precision and purpose that fills every corner. Young women from neighbouring villages

Evidence in Practice Program

Seva’s Evidence in Practice (EIP) program focuses on increasing the ability of eye care institutions to research and improve upon their practices to reach even

Learning and Growing Together

Dear Seva Canada community, Since my last letter to you, I’ve had an extraordinary visit to Seva Canada’s partners in both Nepal and India –

A Vision for Change

Since 2015, Nick has been an avid supporter of Seva Canada, raising nearly $3000 through his “Vision for Change” fundraising campaign. His efforts began while